We can assist with many different plans including:

- 401(k) for Private Employers

- 403(b) for Non-Profit Entities

- 457 Plans for Government Entities

- ESOPS/KSOPS

- SEP/SIMPLE IRAs

- Defined Benefit Plans including Cash Balance

Our Services include:

- Design, Consulting and Special Situations

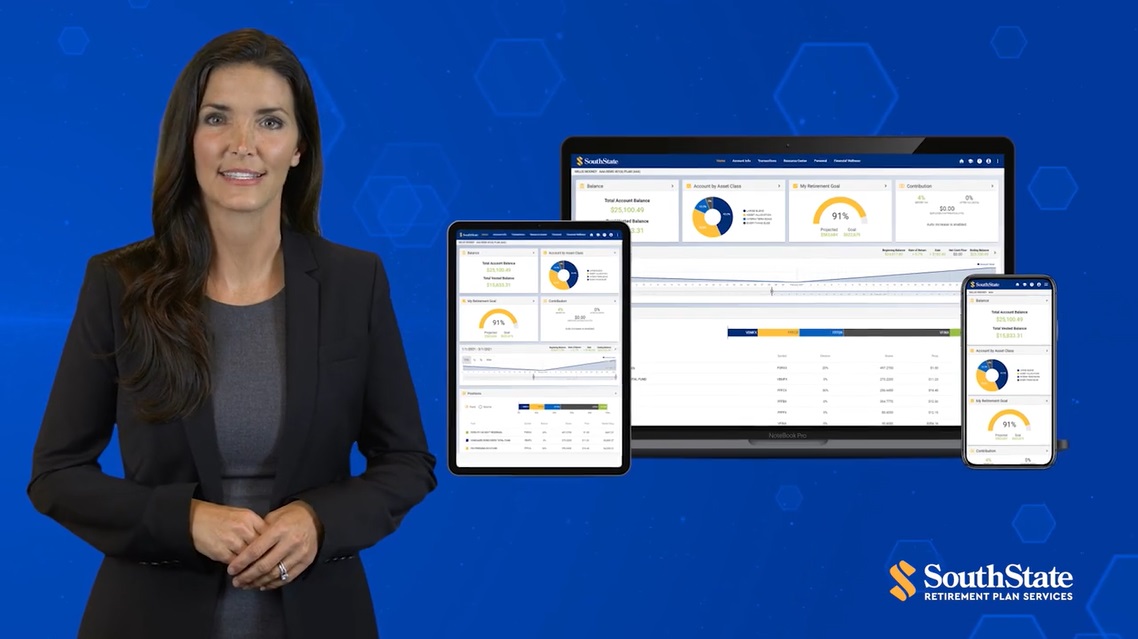

- Platform and Recordkeeping

- Third Party Administration and Compliance

- §3(21) Fiduciary Investment Advisory Services

- §3(38) Fiduciary Investment Management Services

- Fee Analysis and Benchmarking

- Participant Engagement